African Ores FZC, Sultanate of Oman

Tantalum concentrate is a mineral product extracted from specific ore deposits and refined to contain high levels of tantalum pentoxide (Ta₂O₅). It serves as a critical raw material for industries requiring heat-resistant alloys, electronics, and advanced components. This article provides a technical overview of what qualifies as tantalum concentrate, its key characteristics, and its typical sourcing and usage patterns across industrial supply chains.

1. What Qualifies as Tantalum Concentrate

Tantalum concentrate is a trade-specific term referring to partially processed mineral output enriched in tantalum pentoxide (Ta₂O₅). It is distinct from raw ore and refined metal, serving a defined function in the global supply chain. This section explains what transforms ore into concentrate, how it’s classified, and why the term matters in trade, logistics, and contract structure.

1.1 Mineral classification and product status

Tantalum-bearing minerals such as tantalite and columbite are extracted from pegmatite-rich rock formations. Once mined, the raw ore typically contains 2–10% Ta₂O₅ alongside quartz, mica, clay, and heavy metals. Through beneficiation, this mass is concentrated to raise the Ta₂O₅ level to commercially tradable thresholds. When the concentration reaches or exceeds 20%, the material is classified as “tantalum concentrate,” suitable for export and pricing based on chemical content.

Concentrate is a defined commodity class—it’s not simply upgraded ore. It holds a specific HS (Harmonized System) code in customs, requires distinct shipping documentation, and is eligible for international trade under CIF or FOB terms. This distinction also carries legal and financial consequences, affecting insurance, customs clearance, and assay verification requirements.

1.2 Difference between ore, concentrate, and refined forms

Tantalum ore refers to the raw, unprocessed mineral as it exists upon extraction. It is heterogeneous, low in assayable Ta₂O₅, and unsuitable for direct trade unless processed. Concentrate, on the other hand, is the result of physical upgrading that increases the Ta₂O₅ content—usually via mechanical, gravitational, or magnetic methods. It still contains impurities, but within acceptable limits for refinery input.

Refined tantalum comes in metallic form—bars, powder, or ingots—achieved via hydrometallurgical or pyrometallurgical processing of concentrate. It meets high-purity standards (often 99.9% or higher) and is used in capacitors, superalloys, and medical components. The supply chain progression is linear:

scssCopyEditRaw Ore → Concentrate (20–40% Ta₂O₅) → Refined Metal → Finished Component

Each stage has its own commercial value, legal definition, and handling protocol.

1.3 Intermediate role in the supply chain

Tantalum concentrate is the most widely traded form of tantalum in upstream global commerce. Its intermediate position allows it to bridge mining operations and industrial refiners. Unlike ore, it has measurable, verifiable chemical value. Unlike metal, it can be handled in bulk with less regulatory friction.

In practice, concentrate serves several roles:

– Commercial anchor: it is priced per MT based on certified Ta₂O₅ %

– Risk control: allows exporters to monetize material without investing in smelting

– Flexibility: enables importers to feed different refineries with adjustable blends

– Compliance buffer: easier to classify, store, and transport under mineral trade regimes

Refiners treat concentrate as a feedstock. Its quality, packaging, origin, and documentation all affect whether it’s accepted, blended, or rejected. A shipment that meets the “concentrate” threshold unlocks access to international payment instruments (L/C, MT103), port logistics, and SGS inspection frameworks.

2. Chemical Composition and Ta₂O₅ Levels

The commercial definition and value of tantalum concentrate rely almost entirely on its chemical profile—especially the percentage of tantalum pentoxide (Ta₂O₅). This section explains what Ta₂O₅ is, how it’s measured, what ranges define market grade, and how trace elements affect trade eligibility and documentation.

2.1 What is Ta₂O₅ and why it defines pricing

Ta₂O₅ (tantalum pentoxide) is the oxidized form of tantalum in natural minerals. It is the standard unit of measure for evaluating concentrate quality and pricing. Unlike refined metals priced per purity level, concentrate is priced per metric ton with Ta₂O₅ content used as the multiplier.

Example:

If the spot price for Ta₂O₅ is $250/kg and the concentrate contains 30% Ta₂O₅, the indicative value of the material is:

shellCopyEdit30% of 1000 kg = 300 kg → 300 kg × $250 = $75,000 per MT (gross value, subject to discounts)

Buyers don’t pay for total mass—they pay for the recoverable oxide, verified through third-party assays. Therefore, Ta₂O₅ defines the basis for contracts, payment structures, and rejection clauses. Without a certified Ta₂O₅ reading, no shipment qualifies for formal trading or customs clearance.

2.2 Grade categories (20% / 30% / 40%) and their commercial role

Tantalum concentrate is categorized by oxide content into trade brackets. These grades help standardize pricing, buyer expectations, and acceptance terms:

| Grade | Ta₂O₅ Content | Trade Use | Typical Buyer Requirements |

|---|---|---|---|

| Sub-grade | <20% | Reprocessing or local use | Often rejected or discounted heavily |

| Commercial | 20–29% | Accepted in flexible contracts | SGS + XRF required |

| Standard | 30–35% | Export-ready, refinery input | L/C eligible, traceable origin |

| Premium | 36–45%+ | Strategic buyers, long-term deals | Locked price formulas, limited sources |

Some refiners only accept ≥30% Ta₂O₅. Contracts may include “Minimum Acceptable Grade” clauses that trigger penalties if material tests below declared grade. Assays are required pre-shipment, post-loading, and at destination to confirm contract terms.

2.3 Common impurities and their trade impact

Alongside tantalum, the concentrate may include niobium (Nb₂O₅), iron (Fe), manganese (Mn), tin (Sn), and titanium (Ti). Most are inert or accepted within limits. But some elements trigger restrictions:

| Impurity | Typical Tolerance | Trade Impact |

|---|---|---|

| Nb₂O₅ | 5–20% | May be accepted as value-add (or neutral) |

| Iron (Fe) | <3% | Excess affects smelting efficiency |

| Manganese (Mn) | <1% | Limited impact; cosmetic |

| Tin (Sn) | <2% | Can assist in separation |

| Thorium (ThO₂) | <0.12% | Must meet radiation compliance |

| Uranium (U₃O₈) | <0.08% | Highly regulated; overlimit = rejected lot |

Radiation thresholds are especially important for customs clearance, especially in China, the EU, and the UAE. Any exceedance may cause delays, reclassification, or return of cargo.

2.4 How assays are conducted and verified

Ta₂O₅ content and impurity levels are measured using:

– XRF (X-Ray Fluorescence) — Fast, common method used at mine site or port

– ICP-OES / ICP-MS — Laboratory-grade, high precision, required for documentation

– LOI (Loss on Ignition) — Assesses water and organic content; used to adjust dry weight

Assay certificates must include the exact sampling protocol, lab accreditation, batch ID, and date. Buyers may request dual testing—once at loading and again at arrival—to rule out fraud or in-transit tampering.

3. Physical Characteristics and Identification

The physical properties of tantalum concentrate affect how it is classified, packaged, traded, and verified at every stage of the logistics chain. Understanding how it looks, behaves, and differs from unprocessed ore is critical for inspection teams, customs agents, and buyers working with physical lots.

3.1 Typical appearance, particle size, and density

Tantalum concentrate usually presents as a granular, heavy, dark-colored material. The typical particle size ranges from 0.5 mm to 2 mm, with some processed into finer powder depending on the buyer’s requirement. In high-grade batches, the material may show a metallic sheen or “wet” shine under light, while lower grades appear duller or contain residual non-metallic particles.

Color varies by origin and mineral composition:

– Dark gray to black → Common in East African material

– Brownish tones → May indicate higher manganese or tin content

– Red-gray mix → Often tied to residual clay or iron oxides

Density plays a crucial role in verifying content. A well-processed concentrate ranges between 5.5 and 8.5 g/cm³, depending on Ta₂O₅ %, impurities, and moisture. Bulk density (kg/m³) is used for transport calculations and contract volume.

3.2 How to visually distinguish concentrate from ore

Field identification is often the first check performed by customs, buyers, and SGS inspectors. Key differences:

| Feature | Ore (Unprocessed) | Concentrate (Processed) |

|---|---|---|

| Visual Texture | Mixed with visible quartz, clay | Homogeneous metallic fragments |

| Weight per Volume | Lower, due to gangue material | Higher, more compact mass |

| Color Consistency | Variable across sample | Uniform throughout shipment |

| Particle Separation | Loose, irregular, variable sizes | Even, within defined size range |

| Moisture Absorption | Often wet, especially if in open air | Drier, unless improperly packed |

These differences matter: customs offices may detain ore under export restrictions that don’t apply to concentrate. Mislabeling or low-grade appearance may trigger reclassification, fines, or rejection by the importer.

3.3 Factors affecting moisture, weight, and verification

Moisture is one of the most contested variables in concentrate trade. It affects net weight, chemical concentration, and dry-basis calculations.

Key issues:

– Moisture inflates weight: A 3% moisture level in a 25-ton shipment adds 750 kg of non-payable mass

– Dry basis vs wet basis: Payment is usually made on dry basis; certificates must indicate LOI (Loss on Ignition) or % moisture

– Transport impact: Open containers, poorly sealed drums, or long dwell times at port increase moisture levels, especially in humid regions

Many buyers require samples to be oven-dried before assay. Exporters may face deductions or rejection if measured moisture exceeds declared tolerance, typically set at 1–2%. Best practices include:

– Sealing bags or drums with liners

– Including moisture certificates with loading docs

– Using desiccants in packaging

In addition, weight discrepancy between loading and discharge points is often grounds for inspection or claim. That’s why weighbridge certificates, port stamps, and container integrity photos are now common in L/C contracts.

4. Global Sources and Mining Regions

The geographic origin of tantalum concentrate affects its physical characteristics, trade eligibility, and risk perception in commercial transactions. Understanding where it comes from, how it is extracted, and what documentation accompanies it is essential for buyers, refiners, and logistics providers.

4.1 Geographic origin: regions and material profiles

Tantalum-bearing minerals are found across multiple continents, but commercial-scale concentrate is exported primarily from Africa, South America, and Oceania. Each source region offers distinct material profiles, packaging standards, and traceability practices.

| Region | Countries (main) | Typical Ta₂O₅ Range | Export Notes |

|---|---|---|---|

| East Africa | Ethiopia, Rwanda, Burundi | 28–40% | Sealed drums, CIF air, COA and radiation report |

| Central Africa | DRC (Democratic Republic of the Congo) | 20–35% | High volume, variable purity, traceability required |

| West Africa | Nigeria, Ghana | 20–30% | Often requires beneficiation before export |

| Southern Africa | Mozambique, Namibia | 25–35% | Balanced supply, mixed logistics |

| South America | Brazil, Bolivia | 30–45% | Industrial-grade concentrate, consistent assays |

| Oceania | Australia | 30–38% | Stable output, often tied to refining facilities |

DRC remains the world’s largest tantalum ore producer by volume. Its material is widely traded but typically requires additional compliance documentation to meet L/C conditions and ESG screening. By contrast, countries like Ethiopia and Brazil offer more standardized export flows, with higher initial Ta₂O₅ concentration and sealed packaging norms.

Material origin influences not only composition but also how the shipment is handled, priced, and verified. Buyers often factor in regional norms when assessing contract terms, risk tolerance, and required inspection protocols.

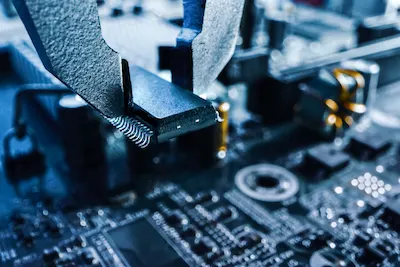

4.2 Extraction and beneficiation techniques

Concentrate quality is determined not only by geology but also by how the ore is processed. Extraction and upgrading methods vary by region and scale:

| Method Type | Used In | Output Stability | Common Format |

|---|---|---|---|

| Manual excavation | Nigeria, Rwanda | Variable | Loose bulk or unsealed |

| Mechanical mining | Ethiopia, Brazil, Australia | High consistency | Sealed drums, bulk bags |

| Gravity separation | Universal | Moderate to high | 30–40% Ta₂O₅ |

| Magnetic filtering | Brazil, Mozambique | Higher purity | Lower iron content |

| Flotation | Industrial setups (Brazil) | Fine powder | Packed in liners |

Countries with structured beneficiation infrastructure (e.g., Brazil, Ethiopia) tend to produce more homogeneous product. Artisanal operations often face challenges with uniformity, particle control, and dry weight consistency. Poor beneficiation can leave quartz, clay, or organics in the lot—lowering commercial grade and triggering reprocessing at buyer’s cost.

4.3 ESG compliance and origin verification

Tantalum concentrate is regulated under various international frameworks due to its sensitivity to conflict mineral concerns. While origin alone does not determine legality or ethical status, it defines the documentation required for trade. Buyers and smelters usually expect:

- Certificate of Origin (COO)

- Mining License or Mine ID

- Assay Report with exact mine site

- Radiation Analysis (ThO₂ / U₃O₈ limits)

- OECD Compliance Declaration

- 3rd-party audit (when required by downstream clients)

Origin traceability also affects payment structure. Some banks require full transparency to issue L/Cs. Others may demand SGS inspections at port of loading. Origin from verified, licensed sites simplifies processing and reduces perceived AML risk. For high-compliance clients, even minor deviations in documentation can lead to rejection.

In practice, geographic origin also influences freight cost, customs clearance speed, and availability of air vs sea routes. For example, Ethiopian concentrate often moves through Bole Airport in sealed batches with SGS tagging. Brazilian lots, in contrast, use port logistics with standard INCOTERMS.

5. Industrial Applications of Tantalum Concentrate

Tantalum concentrate is not used directly in consumer or industrial components. Instead, it enters the upstream phase of advanced manufacturing as a raw input for smelting, refining, and powder metallurgy. This section outlines how different industries rely on the concentrate, what product types it feeds, and how application requirements influence procurement standards.

5.1 Capacitors and electronics

The most significant global demand for tantalum—up to 60%—comes from the electronics sector. After refining, tantalum is converted into high-purity metal powder or wire used in electrolytic capacitors. These capacitors are prized for high energy density, thermal stability, and long lifecycle.

Key downstream applications include:

– Mobile phones, laptops, and tablets

– Medical electronics and implantable devices

– Automotive safety systems (e.g. airbags, braking modules)

– Military-grade communication equipment

To serve this market, concentrate must be traceable, low in radioactive elements, and consistent in chemical profile. Major capacitor producers require documentation back to mine site, often via Responsible Minerals Assurance Process (RMAP) audits.

5.2 Aerospace and superalloys

Tantalum is alloyed with nickel, cobalt, and tungsten to produce high-temperature, corrosion-resistant components. These are used in:

– Jet engine blades and turbine housings

– Rocket nozzles and propulsion systems

– High-performance bearings and thermal shields

Here, purity and elemental consistency are critical. Even small deviations in iron, titanium, or niobium content can affect downstream metallurgical behavior. Buyers in this segment often demand premium-grade concentrate with ≥36% Ta₂O₅ and tightly controlled impurities.

5.3 Additive manufacturing and specialty uses

Tantalum’s biocompatibility and resistance to body fluids make it suitable for powder-based additive manufacturing in:

– Orthopedic implants (hip, spine, skull plates)

– Surgical tools

– Dental prosthetics

Tantalum concentrate is refined into spherical powder via gas atomization or plasma rotating electrode processes. This market favors ultra-low impurity feedstock, especially with respect to iron, carbon, and moisture residues. Trace elements from concentrate, if not removed during refining, may result in brittle failures in 3D-printed components.

5.4 Chemical processing and industrial equipment

Refined tantalum is also used in environments requiring acid resistance and thermal durability, such as:

– Heat exchangers for sulfuric and hydrochloric acid

– Lined pipes and tanks in chemical plants

– Coatings in high-purity gas systems

These applications require extremely stable metallurgy. Refineries feeding this market prioritize concentrate with uniform grain structure, stable oxide profile, and minimal trace elements that could interact under pressure or heat.

6. Commercial Formats and Logistics

The physical delivery of tantalum concentrate is governed by specific handling, packaging, and shipping protocols. These logistics details affect trade classification, inspection workflows, customs clearance, and payment execution. This section outlines how concentrate is prepared, moved, and documented in global trade environments.

6.1 Packaging: drums, bags, and sealing methods

The industry standard for tantalum concentrate packaging is the use of sealed high-density polyethylene (HDPE) drums, each filled with 25 kg of material. Drums are often double-lined with plastic bags to minimize moisture and contamination. Each drum is individually labeled with:

– Lot number and batch code

– Gross and net weight (in kg)

– Ta₂O₅ content (declared or range)

– Country of origin

– Radiation declaration (“<0.1% ThO₂ / <0.08% U₃O₈”)

– Date of packing and container ID

Drums are typically palletized and shrink-wrapped in lots of 800–1000 kg. Some bulk shipments use woven polypropylene jumbo bags (“big bags”) lined with moisture barriers—often in 1 MT units. However, drums are preferred for export where handling precision, customs compliance, or radiation scrutiny is involved.

6.2 Shipping terms and loading standards

Most international shipments are handled under CIF (Cost, Insurance, Freight) or FOB (Free On Board) Incoterms. CIF is common when the seller arranges ocean or air freight, while FOB is typical for port-handled containerized shipments.

Key loading practices include:

– Stuffing 20-foot or 40-foot containers with pallets of sealed drums

– Issuing photos of loaded containers (before sealing) for L/C requirements

– Applying tamper-evident security seals with serial number documentation

– Declaring gross container weight for vessel stowage and customs

Shipping documents must match container manifests precisely. Any inconsistency in declared net vs actual weight, number of drums, or markings can delay clearance or invalidate trade documents.

6.3 Customs, weight tolerance, and documentation

Customs authorities require full alignment between physical cargo and submitted paperwork. This includes:

– Packing List: must list drum count, individual and total weights

– Commercial Invoice: includes unit price, total value, HS code, country of origin

– Certificate of Assay: signed and dated, with batch ID and lab details

– Certificate of Radiation Safety: mandatory for most ports

– COO (Certificate of Origin): often authenticated by chamber of commerce

Most trade contracts allow a weight deviation margin of ±1% between declared and actual net mass. Any variance above this range must be disclosed and jointly acknowledged by both parties. If the discrepancy is discovered after customs inspection, it may affect the L/C settlement or trigger a penalty clause.

7. Quality Control and Documentation

Every shipment of tantalum concentrate must be backed by technical documentation and third-party verification. These elements protect both buyer and seller from disputes over grade, origin, or compliance. This section outlines what documents are required, how testing is performed, and what practices are standard in international trade.

7.1 SGS, Assay, COA, and Radiation Reports

The foundational documents accompanying any export shipment include:

– SGS Certificate (or equivalent inspection provider): confirms quantity, drum count, packaging integrity, container sealing, and visible consistency.

– Certificate of Assay (COA): lists the verified Ta₂O₅ content (e.g., “30.82% Ta₂O₅”), impurity levels (Fe, Nb, U, Th), moisture %, date, batch number, and lab credentials.

– Radiation Report: required at port of export and by many import authorities. Declares concentrations of thorium (ThO₂) and uranium (U₃O₈), usually tested by ICP-MS. Thresholds for clearance:

– ThO₂: <0.12%

– U₃O₈: <0.08%

– COO (Certificate of Origin): typically issued by a national chamber of commerce or mining authority, confirms the country of extraction and production.

All documents must match the physical shipment (lot ID, container number, drum count) and be dated within 30 days of loading. Discrepancies can delay customs clearance or trigger L/C rejection.

7.2 Typical SPA clauses and L/C practices

In formal trade contracts (SPA — Sales and Purchase Agreement), buyers often include clauses that define acceptable quality variance, inspection protocols, and documentation procedures. Examples:

– Minimum Acceptable Grade: e.g., “not less than 30.00% Ta₂O₅ dry basis”

– Assay Confirmation Right: buyer reserves the right to retest upon arrival

– Moisture Limit: “max 1.5% moisture at time of loading”

– Rejection Protocol: if discrepancies >2% arise in Ta₂O₅ or weight, shipment may be rejected or discounted

For L/C (Letter of Credit) transactions, banks require a full set of documentation — including Packing List, Commercial Invoice, COA, COO, Radiation Report, and SGS certificate — to trigger payment release. All must match exact L/C wording.

7.3 How buyers verify product quality

Upon arrival, buyers typically perform a combination of:

– Weight re-verification at port or warehouse

– Drum inspection for tampering, leakage, or mislabeling

– Random sample assay to confirm Ta₂O₅ content

– XRF screening for field-level validation

– Document cross-check to ensure shipment matches declared values

If inconsistencies are found, resolution may include:

– Partial payment hold

– Re-assay at neutral lab

– Activation of penalty clauses in SPA

– Future batch testing before dispatch

Professional buyers often build long-term supplier relationships based on documentation reliability and batch stability. Even if chemical grade is acceptable, failure in paperwork or process flow can permanently exclude a seller from future deals.

8. How to Recognize Market-Grade Tantalum Concentrate

Not all material labeled “tantalum concentrate” qualifies for international trade. Buyers, inspectors, and financiers rely on a set of technical, visual, and documentary criteria to distinguish valid concentrate from sub-grade or misrepresented shipments. This section outlines how to evaluate a lot before export or acceptance.

8.1 Visual and analytical checklist

To qualify as market-grade concentrate, a shipment should meet the following combined criteria:

| Category | Standard Requirement |

|---|---|

| Ta₂O₅ Content | ≥ 30.00% on dry basis (preferably verified twice) |

| Impurities | Within trade limits (esp. U, Th, Fe) |

| Moisture | ≤ 1.5% at loading (declared and tested) |

| Particle Size | 0.5 mm – 2 mm, uniform, free from visible gangue |

| Color & Texture | Consistent, metallic/black/grey, non-clayey |

| Packaging | Sealed drums or lined big bags, labeled and palletized |

| Documentation | COA, SGS, Radiation Report, COO — all aligned |

| Inspection Access | Full visibility and sampling allowed before loading |

Any deviation should be disclosed pre-shipment and contractually agreed. Buyers increasingly use pre-loading video inspection and third-party tagging systems to certify visual conformity.

8.2 Red flags and typical rejection reasons

Buyers, refineries, and customs may reject shipments for reasons including:

– Ta₂O₅ content < 28% without prior notice

– Incomplete or inconsistent assay reports

– Moisture content undeclared or above agreed threshold

– Visible presence of quartz, feldspar, or clay

– Radiation levels exceeding 0.12% ThO₂ or 0.08% U₃O₈

– Discrepancy in lot weight (± >1.5%)

– Drum damage, leakage, or mismatched labeling

– Country of origin not aligned with documentation

These issues not only trigger commercial disputes but may block L/C payments, increase demurrage costs, or require re-export at seller’s expense.

8.3 Trade filter: how professionals qualify concentrate lots

In practice, buyers and traders use a 3-step model to assess whether a shipment qualifies as market-grade concentrate:

- Grade Check

→ Confirm Ta₂O₅ via certificate + spot assay

→ Review impurity table: is it refinery-grade? - Format Check

→ Packaging: Is it export-ready?

→ Particle profile: Is it free of visible contamination? - Documentation Check

→ Do all documents match: COA, COO, Radiation, Invoice?

→ Are they recent, complete, and properly signed?

Only if all three layers pass, the cargo is accepted without discount or delay.

Looking for Verified Tantalum Concentrate?

We supply sealed-drum Tantalum Concentrate (≥30% Ta₂O₅) with full assay, radiation clearance, and SGS inspection. Standard CIF terms, export-ready documentation, and consistent batch quality.

View Product Specifications

Global Demand for Tantalum: Applications and Growth Forecasts

Tantalum’s unique physical and chemical properties — corrosion resistance, high melting point, and capacitive efficiency…

Risks and Volatility in the Tantalum Market: Supply, Pricing, and Trade Disruptions

Tantalum supply chains remain structurally fragile, with concentrated origin zones, limited transparency, and exposure to…

How To Compare Tantalum Concentrate Offers: Price, Specs, Compliance, and Supplier Risk

Tantalum concentrate offers vary widely in price, specification, delivery terms, and documentation quality. For buyers…

Tantalum Concentrate Price Trends: Key Drivers and Market Dynamics

Tantalum concentrate prices reflect tight supply conditions, complex logistics from African origin countries, and growing…