African Ores FZC, Sultanate of Oman

High-grade tantalum concentrate must meet strict physical, chemical, and documentation standards. Buyers rely on both visual indicators and certified analysis to confirm shipment quality before acceptance. This guide outlines practical steps and technical criteria used across the supply chain to identify premium-grade material and avoid substandard or diluted batches.

1. Key Attributes of High-Grade Tantalum Concentrate

High-grade concentrate meets specific thresholds across chemical composition, moisture stability, and documented traceability. These parameters define material that is accepted by global refineries and used in high-yield extraction processes. Below — the baseline metrics used by buyers and labs to assess incoming shipments.

1.1 Ta₂O₅ Content Thresholds

- Minimum Accepted Grade:

Commercial-grade concentrate begins at 25% Ta₂O₅, but high-grade shipments start at ≥30%. This level ensures compatibility with refinery input specs and predictable metallurgical recovery. Material above 32% is preferred due to reduced loss during processing and higher yield per ton. - Dry Basis Requirement:

Ta₂O₅ percentage must be calculated on a dry weight basis. Moisture content skews results and can lead to overpayment. Laboratories such as Alex Stewart International or DRA always correct for water content in final reporting. Contracts should explicitly reference dry basis figures. - Incremental Yield Impact:

Each additional percentage point of Ta₂O₅ improves yield economics. For example, a 35% sample delivers roughly 15–20% more usable oxide compared to 30%, assuming similar impurity levels. This affects pricing, refinery throughput, and batch prioritization. - Sampling and Reporting Standards:

Valid COAs must include batch ID, dry weight reference, date of extraction, inspection report by Alex Stewart International, assay report, Certificate of Origin, radiation clearance, and export license. Reports lacking these fields are considered non-compliant. Buyers should always cross-verify with original assay documents before accepting CIF terms or remittance.

1.2 Presence of Niobium and Associated Elements

Alongside tantalum, high-grade concentrate typically contains measurable levels of niobium (Nb₂O₅), which adds both industrial value and strategic interest. While Ta₂O₅ remains the primary focus, buyers and processors assess associated oxides to understand overall yield potential, element separation efficiency, and batch marketability.

- Niobium Content Range:

High-quality batches often show Nb₂O₅ levels between 5–12%. This is not always priced separately, but it influences buyer interest—especially in markets where niobium is in demand for alloy production or capacitor-grade applications. - Balance Between Ta and Nb:

A favorable Ta-to-Nb ratio suggests a cleaner ore source and lower processing complexity. Batches with excessive niobium may signal altered ore formation or dilution, which requires additional refining steps. A typical high-grade ratio is 3:1 or higher (Ta:Nb). - Additional Trace Elements:

Minor components like titanium, tin, and tungsten are often present. While not always detrimental, their levels must remain below thresholds specified in refinery intake guidelines. Tin (Sn) above 1% or tungsten (W) above 0.5% can complicate separation chemistry. - Radioactive Element Limits:

Uranium (U₃O₈) and thorium (ThO₂) must fall within strict limits—usually <0.08% and <0.12% respectively. Elevated levels trigger customs holds, export license issues, or outright rejection. Third-party labs always test for these as part of compliance clearance. - Declared vs. Actual Content:

Suppliers must align declared values with third-party reports. Discrepancies between seller claims and lab results are a red flag. Buyers should request assay source details (e.g., DRA or Alex Stewart International sample IDs) to validate declared content against independent inspection.

1.3 Moisture Level and Physical Stability

High-grade concentrate must arrive dry, stable, and ready for processing. Excessive moisture, unstable granules, or poor containment compromise both assay accuracy and shipping compliance. Buyers evaluate moisture content, particle integrity, and packaging reliability as part of quality acceptance.

- Acceptable Moisture Levels:

Target moisture content is <0.5% by weight. Anything above 1% requires drying before processing and may distort assay readings. Moisture also increases shipping weight, leading to inflated CIF values. Reliable sellers include moisture metrics in COA reports. - Clumping and Granular Breakdown:

Well-processed concentrate maintains a loose, free-flowing texture. Clumping or hardened blocks suggest improper storage, humidity exposure, or chemical reactions during transit. This affects sampling accuracy and may signal deeper stability issues. - Packaging-Induced Contamination:

Insecure packaging allows contact with ambient air, resulting in oxidation or moisture absorption. Drums must be airtight and sealed at source. Buyers often request photographic proof of sealed units before shipment. - Visual Mold or Biological Traces:

Visible mold, fungal presence, or insect contamination signals warehouse exposure to organic material. Even if content meets grade specs, such batches are rejected on hygiene grounds in ports with strict biosecurity rules (e.g. China, EU). - Sample Consistency Across Drums:

Moisture and particle separation may occur during bulk handling. Labs typically request samples from multiple drums to confirm consistency. Any major deviation triggers re-inspection or batch quarantine.

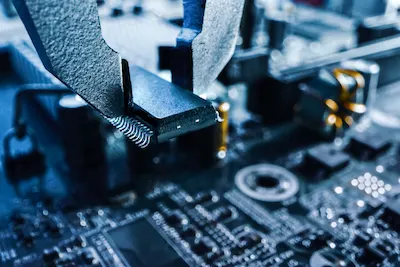

2. Visual and Physical Clues for On-Site Assessment

While laboratory tests remain the standard, physical inspection offers quick insights into batch quality before sampling or lab submission. Experienced buyers use color, texture, and containment cues to validate shipments on-site or during customs clearing.

2.1 Color Indicators and Mineral Visibility

- Typical Color Range:

High-grade concentrate usually appears dark gray to black, sometimes with a metallic sheen. Light brown, reddish, or yellow tones may indicate high clay content or oxide dilution — often undesirable. - Metallic Luster:

Presence of shiny particles often correlates with high tantalite density. Matte or dull surfaces suggest higher contamination or presence of silicates and organics. - Spot Testing with Magnification:

A handheld lens (10x–20x) reveals mineral distribution. Uniform coloration with dense particles signals good beneficiation. Irregular patches or layered discoloration imply mixed sourcing or poor washing.

2.2 Texture and Particle Size Uniformity

- Preferred Granule Size:

Most buyers prefer medium to coarse granules (1–5 mm). Powdered material tends to hold moisture and shows higher assay variation. Extremely large particles may require crushing before lab analysis. - Texture Test:

When rubbed between fingers (with gloves), high-grade concentrate should feel firm and granular. Sticky or clay-like consistency indicates excess fines, organic carryover, or poor drying. - Absence of Visible Debris:

Wood chips, plastic, insects, or fiber residue reflect poor screening and affect perception of quality. Top-tier exporters eliminate these during final packaging.

2.3 Packaging Condition at Inspection

- Drum Type and Labeling:

Drums should be thick plastic or steel, 25–50 kg capacity, with proper seals. Each must bear a batch number, net weight, origin, and date. Handwritten or missing labels reduce traceability. - Seal Integrity:

Unbroken tamper seals are required. Customs officers often photograph intact seals during clearance. Replacement of seals without declaration is a red flag. - Pallet and Container Hygiene:

Drums should be palletized, shrink-wrapped, and clear of external residue. Port inspectors review container floors and pallet bases for leaks or contamination.

3. Lab Testing and Third-Party Verification

Laboratory testing confirms whether a batch meets commercial thresholds and compliance requirements. Most importers and processors mandate third-party verification from certified labs to reduce risk, ensure accuracy, and facilitate customs clearance.

3.1 Core Parameters in Laboratory Analysis

- Ta₂O₅ Assay:

The primary metric. Labs use XRF, ICP-OES, or wet chemical methods to determine tantalum oxide percentage. Target range for high-grade concentrate is ≥30%. Results are shown with precision (e.g., 30.42 ± 0.15%). - Nb₂O₅ and Other Oxides:

Secondary elements like niobium, tin, and tungsten are also measured. Buyers analyze these to assess yield and potential processing adjustments. Labs report all oxide percentages in a single chart. - Loss on Ignition (LOI):

Indicates moisture and volatile matter. High LOI values (>2%) often trigger rejection or renegotiation. Acceptable range is usually below 1%. - Radioactive Elements:

U₃O₈ and ThO₂ are tested with high-sensitivity instruments. Typical acceptance thresholds: U₃O₈ <0.08%, ThO₂ <0.12%. Batches exceeding this require export licenses and may be barred in specific jurisdictions.

3.2 Role of Third-Party Inspectors (e.g., Alex Stewart International, DRA)

- Sampling Supervision:

Inspectors ensure samples are drawn from multiple sealed drums, following international procedures. This reduces manipulation risk and improves data credibility. - Independent Assay Reports:

Labs like Alex Stewart International and DRA issue formal documents stamped, signed, and often notarized. These are required by banks, shipping agents, and some customs authorities. - Chain of Custody Certification:

Top-tier labs offer optional chain-of-custody services, tracking each sample from source to report issuance. This is crucial for institutional buyers or government contracts.

3.3 Validating Supplier Claims

- Compare Seller vs. Lab Results:

Always cross-check internal declarations with third-party outcomes. Significant gaps indicate inconsistencies, misrepresentation, or poor sampling. - Request Original Certificates:

Insist on original scanned lab reports (not only summary tables). Verify signatures, barcodes, and sample IDs match declared batch data. - Check Lab Credentials:

Only accept reports from internationally recognized labs with ISO/IEC 17025 or equivalent certification. Informal, local lab results rarely hold weight in regulated markets.

4. Handling, Compliance, and Export Readiness

Beyond purity, high-grade concentrate must meet handling, documentation, and compliance expectations. Authorities and buyers scrutinize each shipment’s conformity with safety, legal, and logistical norms. Operational gaps in this phase often block deals or delay customs.

4.1 Radiation Clearance and Material Safety

- Safety Screening Requirements:

All shipments must pass gamma spectrometry or equivalent tests to confirm absence of harmful radioactivity. Customs agents and port authorities may detain goods until radiation reports are filed. - Documentation Format:

Clearance certificates should clearly state: test method, isotope levels, lab name, and batch reference. Values for U₃O₈ and ThO₂ must remain within permissible thresholds. - Handling Protocols:

Workers involved in loading/unloading must wear gloves and masks. While the concentrate is not classified as hazardous under UN shipping codes, good practice minimizes dust inhalation and contact risk. - DRA & Alex Stewart International Approvals:

These labs, including Alex Stewart International and DRA, provide standardized radiation clearance reports recognized at major ports (Guangzhou, Antwerp, Dubai, etc.). Shipments with their stamps pass inspection faster and with fewer delays.

4.2 Export Documentation and Batch Traceability

- Essential Documents:

Each shipment must include a commercial invoice, packing list, Certificate of Origin (CoO), radiation clearance, and assay report. Larger transactions may require L/C instructions or SPA annexes. - Batch Labeling Standards:

Each drum should have a printed label including:

– Product name

– Batch number

– Date of packing

– Origin country

– Net weight - Digital Records:

Exporters should maintain cloud-based copies of all certificates and inspection images. This facilitates buyer access, resolves disputes, and builds trust with repeat customers.

4.3 Customs and Port-Specific Considerations

- Preferred Ports for Inspection:

Major hubs like Guangzhou Baiyun (air), Durban (sea), and Mombasa have defined tantalum protocols. Working with these ports simplifies customs formalities. - Packaging Protocols:

Customs prefers shrink-wrapped pallets with clear labeling. Drums must be accessible for random checks. Drums with broken seals, excessive dust, or inconsistent weights raise red flags. - Shipping Modes:

Air freight (for small high-value lots) and sea freight (for bulk shipments) each require different handling documents. Shippers must adapt Incoterms and insurance to mode.

Looking for Verified High-Grade Tantalum Concentrate?

We supply sealed-drum Tantalum Concentrate (≥30% Ta₂O₅), fully inspected by DRA or Alex Stewart International, radiation-cleared, and export-ready. Consistent batches with detailed documentation.

View Product Details

Global Demand for Tantalum: Applications and Growth Forecasts

Tantalum’s unique physical and chemical properties — corrosion resistance, high melting point, and capacitive efficiency…

Risks and Volatility in the Tantalum Market: Supply, Pricing, and Trade Disruptions

Tantalum supply chains remain structurally fragile, with concentrated origin zones, limited transparency, and exposure to…

How To Compare Tantalum Concentrate Offers: Price, Specs, Compliance, and Supplier Risk

Tantalum concentrate offers vary widely in price, specification, delivery terms, and documentation quality. For buyers…

Tantalum Concentrate Price Trends: Key Drivers and Market Dynamics

Tantalum concentrate prices reflect tight supply conditions, complex logistics from African origin countries, and growing…