African Ores FZC, Sultanate of Oman

Tantalum’s unique physical and chemical properties — corrosion resistance, high melting point, and capacitive efficiency — make it critical to several high-value industrial sectors. While supply remains geographically narrow, global demand continues to grow, driven by electronics, aerospace, medical implants, and advanced manufacturing. For procurement planners, exporters, and trade partners, understanding where this demand comes from — and where it’s going — is essential to assessing long-term market dynamics.

1. Core Applications of Tantalum Across Industries

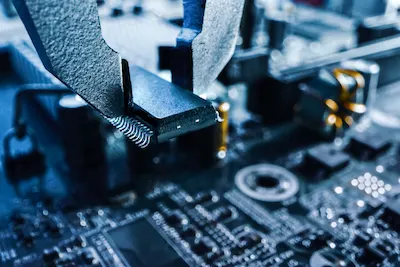

Tantalum’s industrial importance lies in its stability under extreme conditions, high capacitance-to-volume ratio, and resistance to chemical corrosion. These properties make it irreplaceable in several mission-critical components across modern manufacturing and electronics. Understanding the full application landscape helps quantify why demand remains steady and resilient through market cycles.

1.1 Electronics and capacitors

Tantalum capacitors are compact, stable, and temperature-tolerant — used in smartphones, laptops, servers, automotive electronics, and military systems. They dominate high-reliability circuits where failure is not acceptable.

– As of 2025, over 35% of global tantalum consumption is used in capacitor-grade powder

– The segment grows in parallel with global chip and module output

– Multilayer ceramic capacitors (MLCCs) do not fully replace tantalum in size-constrained or high-performance devices

1.2 Aerospace and superalloys

Tantalum enhances the strength, thermal resistance, and corrosion tolerance of nickel- and cobalt-based superalloys used in:

– Jet engines and turbine blades

– Rocket components

– Chemical processing heat exchangers

It is also used in protective coatings for military-grade steel and high-performance metal parts that must endure heat and oxidizing environments. Aerospace accounts for roughly 20–25% of industrial tantalum demand, with growth tied to jet engine production cycles and defense budgets.

1.3 Medical and dental implants

Due to its biocompatibility and inert behavior in the human body, tantalum is used in:

– Orthopedic implants (hip, spine, and knee components)

– Cranial and dental reconstruction

– Surgical tools and pacemaker casings

Although volume is lower than in electronics, margins are significantly higher. The medical sector is forecasted to expand its tantalum usage at 6–7% CAGR through 2030, especially in North America and Europe.

1.4 Chemical processing and corrosion-resistant components

Tantalum is used in anti-corrosive linings, reaction vessels, pipes, and condensers within the chemical, nuclear, and semiconductor industries. Its ability to resist attack by strong acids and high temperatures makes it indispensable in extreme chemical environments.

1.5 Thin-film coatings and optical applications

Tantalum pentoxide (Ta₂O₅) is used in thin films for optical lenses, sensors, and anti-reflective coatings in precision instruments and laser equipment. It also appears in dielectric layers of DRAM and storage chips.

—

Tantalum is not a bulk commodity — it is a critical input in high-value, high-reliability systems. Its applications are diversified across sectors with little material substitution risk, supporting structurally stable demand even amid upstream disruptions.

2. Geographic Demand Centers and Import Patterns

Global tantalum demand is concentrated in five primary industrial regions — China, Germany, United States, South Korea, and Japan — each playing a distinct role in refining, component manufacturing, and final product assembly. While tantalum is not consumed in massive tonnages, its strategic importance means import patterns are closely tied to national industrial policy, defense procurement, and supply chain security.

2.1 China: the dominant refining and capacitor hub

China is the world’s largest consumer and processor of tantalum concentrate, accounting for over 50% of global imports as of 2025.

– Major applications include electronics (capacitors), superalloy components, and optical systems

– Chinese refiners import raw concentrate, process it into powder, wire, and oxide forms, and redistribute it domestically or export in semi-finished state

– CIF shipments arrive primarily through ports in Guangzhou and Ningbo, with import scrutiny focused on radiation (U/Th) limits and traceability

Growth in China’s automotive electronics, EV powertrains, and AI data center infrastructure continues to drive internal demand for high-grade tantalum powder and metal.

2.2 Germany: medical, aerospace, and EU compliance-intensive use

Germany is Europe’s largest tantalum consumer, with applications in:

– Aerospace turbine components

– Biocompatible medical implants and surgical tools

– Specialized chemical processing equipment

German buyers place strong emphasis on traceability and ESG documentation, including ITSCI certification and EU Conflict Minerals Regulation compliance. Imports are often routed through EU bonded logistics hubs and processed in high-spec metallurgical plants.

2.3 United States: defense and advanced manufacturing

U.S. demand focuses on national security and industrial autonomy. Key applications include:

– Military-grade electronics and secure communications

– Jet propulsion systems for defense and aerospace

– Semiconductor-grade thin films

The U.S. Department of Defense classifies tantalum as a strategic and critical material. Although total consumption is lower than China’s, contractual and compliance stringency is highest. DLA (Defense Logistics Agency) oversees certain long-term stockpile and sourcing mechanisms.

2.4 South Korea and Japan: precision electronics and semiconductors

Both countries import high-purity tantalum for use in:

– Mobile and consumer electronics

– DRAM, NAND, and SoC chip production

– Capacitors in compact form factors

Due to their dependence on imported raw material, Korea and Japan maintain diversified sourcing strategies and long-term offtake contracts with African and South American exporters.

2.5 India and Southeast Asia: emerging but fast-growing

India’s medical implant and electronics sectors are expanding, increasing the country’s demand for processed tantalum. Southeast Asian nations (e.g., Malaysia, Vietnam) are building value-added capacity in capacitors and coatings, often sourcing through Chinese refiners.

—

Import patterns reflect industrial specialization:

– China dominates raw intake and processing

– Germany and the U.S. enforce compliance and specialization

– Japan and Korea prioritize precision and volume reliability

Tantalum trade flows follow not just demand — but regulatory infrastructure, ESG expectations, and the buyer’s ability to absorb risk. Exporters must understand these patterns to tailor pricing, documentation, and logistics accordingly.

3. Technology-Driven Demand Growth: 2025–2030

Tantalum’s role in modern technology is expanding beyond traditional capacitor use. As global industries accelerate digitalization, electrification, and miniaturization, demand for high-purity tantalum powder, superalloys, and thin-film coatings continues to grow. Understanding these emerging drivers is essential for procurement and strategic planning.

3.1 Advanced electronics and miniaturization

Devices across sectors — from consumer gadgets to aerospace systems — demand increasingly compact, high-performance electronic components. Tantalum capacitors remain unmatched in volumetric efficiency and thermal stability, especially in:

– Smartphones and tablets (compact logic boards)

– Automotive electronics (ADAS, EV battery control units)

– Defense-grade systems (radar, avionics, communication)

While alternative capacitor technologies exist, they do not displace tantalum in space- or heat-constrained environments. OEMs scaling high-performance devices continue to increase their tantalum consumption per unit.

3.2 AI infrastructure and high-density data centers

With the global boom in AI and edge computing, tantalum demand is tied to hardware backbones:

– GPU and accelerator boards with stable capacitor arrays

– Solid-state memory modules (SSD, DRAM) requiring dielectric films with high breakdown voltage

– Servers and edge devices deployed in thermally extreme environments

Tantalum pentoxide (Ta₂O₅) thin films are widely used in DRAM capacitors and high-reliability logic elements. As AI infrastructure scales, so does demand for high-purity oxide material.

3.3 Medical implants and surgical innovation

The shift toward additive manufacturing in medical device production — particularly 3D-printed porous implants — is expanding tantalum’s usage in orthopedics, neurosurgery, and dental reconstruction. Its unmatched biocompatibility and ability to promote osseointegration make it ideal for:

– Custom hip and spinal implants

– Cranial plates and trauma hardware

– Dental mesh and anchor systems

North America, Europe, and parts of East Asia are adopting these innovations rapidly, with CAGR in medical tantalum use projected at 6–8% through 2030 (source: Roskill 2025 outlook).

3.4 Green energy and industrial electrification

Energy storage systems, battery management modules, and high-voltage converters in wind, solar, and grid systems increasingly use tantalum capacitors and coatings. Tantalum’s role in resisting heat and chemical degradation ensures system longevity in:

– Inverters and charge controllers

– Energy-dense battery switching systems

– Harsh-environment converter modules

Though nascent, this vertical adds new, steady-volume demand from utility and infrastructure players.

3.5 Aerospace and hypersonic development

Next-generation propulsion systems — including reusable space launch systems and hypersonic aircraft — utilize tantalum-based alloys and coatings to survive extreme conditions. These programs are no longer experimental: defense and private-sector investments are scaling material procurement.

—

Tantalum’s demand growth is no longer limited to smartphones or defense. It is now embedded in AI, electrification, and biomedicine — sectors with multi-decade investment cycles. Buyers positioned to secure compliant supply chains and oxide-grade material will benefit from this structural tailwind through 2030 and beyond.

4. Supply vs. Demand Outlook: Strategic Pressure Points

As demand for tantalum accelerates across multiple sectors, the market faces structural pressure from a constrained and inflexible supply base. Without new primary production or major recycling breakthroughs, the gap between consumption and availability is expected to tighten — increasing both price sensitivity and geopolitical relevance.

4.1 Projected demand outpaces secure supply

According to Roskill and Wood Mackenzie (2025 market forecasts), global demand for tantalum concentrate is expected to grow at 4.5–5.2% CAGR through 2030. Key drivers include:

– 5G device proliferation and automotive electrification

– Expansion of DRAM/NAND chip capacity

– Medical implant adoption in aging populations

– Defense and aerospace procurement cycles

By contrast, known supply from all compliant sources (≥30% Ta₂O₅, radiation limits met, export-licensed) is projected to grow only 2.5–3% CAGR, largely limited by:

– Geographic constraints (70%+ of supply from Africa)

– ESG-driven shutdowns of artisanal output

– Lack of capital investment in new industrial-scale mines

4.2 Recycling potential remains limited

While tantalum is recyclable, volumes are insufficient to offset demand growth.

– Electronics recycling yields low recovery rates due to small component size and complex disassembly

– Medical and aerospace components have long in-use lifespans (10–30 years), delaying material return

– Estimated secondary supply covers less than 20% of total annual consumption through 2025–2030

4.3 Strategic stockpiling and hoarding behavior

OEMs and government-linked entities increasingly pursue stockpiles or vertical integration:

– U.S. Defense Logistics Agency maintains strategic reserves

– Chinese state-affiliated buyers sign long-term offtake agreements and invest in upstream refining

– Aerospace and medical OEMs seek to lock in future supply via toll-processing or closed-loop models

This reduces spot availability, tightens the open market, and pushes up CIF pricing, particularly for verified batches with full compliance.

4.4 Lack of scalable new mining projects

Despite known geological deposits in South America, Southeast Asia, and parts of Central Africa, most new tantalum projects face high barriers:

– Capex >$100M for scalable extraction

– Environmental permitting and ESG requirements

– Co-location with conflict zones or unstable governments

As of July 2025, no new large-scale mine with >300 t/year output has reached operational status since 2019.

4.5 Compliance-driven segmentation of supply

Even among existing producers, only a subset can meet documentation, radiation, and traceability standards required by top-tier buyers. This creates a two-tier market:

– Compliant, traceable batches trade at a 10–20% premium

– Unverified material is excluded from corporate, defense, and medical supply chains

—

The market for tantalum is entering a structurally tight phase: steady demand growth meets fragmented, slow-moving supply. Buyers unable to secure long-term compliant sources will face volatility in both price and availability — especially during geopolitical or logistics shocks. Strategic procurement planning, supplier development, and ESG alignment will define competitive advantage through the end of the decade.

5. Takeaways for Exporters, Traders, and Buyers

Understanding global demand is not a theoretical exercise — it’s a blueprint for action. Tantalum’s long-term consumption trends reveal where opportunities exist, how procurement risk evolves, and what capabilities buyers and sellers must build to stay competitive. This section translates market dynamics into direct operational priorities for those managing contracts, sourcing, and exports.

5.1 For exporters in Africa and South America

Exporters must align product, documentation, and logistics to serve high-growth demand regions (China, Germany, U.S., Japan). This means:

– Consistent Ta₂O₅ quality: ≥30% concentrate remains the standard for long-term buyers

– Inspection report by Alex Stewart International, assay report, Certificate of Origin (CoO), radiation clearance, and export license.

– Packaging: 100 kg sealed plastic barrels with printed batch ID and moisture protection.

– CIF readiness: mastering end-to-end delivery, including freight booking, customs prep, and inspection timing

Exporters able to deliver traceable, high-grade, CIF-cleared batches will capture price premiums and preferred-supplier status.

5.2 For international traders and logistics partners

Trading firms must move beyond margin arbitrage and build operational precision:

– Track real-time demand signals in target countries: import data, tech production cycles, refinery capacity

– Maintain flexible sourcing routes to offset corridor-specific delays (e.g., Kigali vs. Entebbe vs. Nairobi)

– Use contract templates with built-in risk buffers: inspection variance clauses, re-export terms, staged payments

– Develop compliance intelligence: understand documentation expectations by geography (e.g., stricter ESG in EU, tighter radiation enforcement in China)

Winning traders combine product access with documentation mastery and cargo reliability.

5.3 For B2B buyers and procurement teams

Buyers face rising demand, tightening supply, and compliance pressure. To adapt, they must:

– Establish multi-supplier programs, not single-point sourcing

– Build long-term offtake relationships with verified exporters

– Allocate budget flexibility for ESG-compliant premiums (USD 10–20/kg above open market)

– Invest in in-house verification tools: radiation meters, lab partnerships, assay interpretation capacity

– Monitor downstream trends in electronics, aerospace, and medical sectors, aligning sourcing volume to forward production

Smart buyers think in cycles — not just shipments. Contracting based on 6–12 month demand planning, with optionality for expansion, is replacing one-off spot deals.

5.4 Market behavior forecast: 2025–2030

| Factor | Direction | Strategic Implication |

|---|---|---|

| Global demand | ↑ steady growth | Volume stability across sectors |

| High-grade supply (≥30% Ta₂O₅) | ↔ flat/sluggish | Source locking and contract control |

| Compliant documentation | ↑ strictness | Full compliance as entry threshold |

| Spot pricing volatility | ↑ rising | Risk-adjusted deal structures required |

| ESG traceability requirements | ↑ intensifying | Supplier qualification will narrow pool |

Conclusion:

The tantalum market is no longer volume-driven — it is reliability- and compliance-driven. Exporters who invest in quality and documentation, traders who manage logistics and contracts with discipline, and buyers who plan against real consumption cycles will control supply under tightening conditions.

The opportunity is structural — but only for those who are operationally prepared.

Disclaimer:

All demand forecasts, market shares, and industrial usage insights in this article are based on publicly available data as of July 2025, including reports from Roskill, Wood Mackenzie, and Shanghai Metal Market (https://www.smm.cn — subscription required). Figures are indicative, not exhaustive, and do not constitute investment advice or contractual recommendations. Readers should validate all market assumptions and forward-looking data with primary sources before making commercial or procurement decisions.

Looking to Serve Long-Term Tantalum Demand?

We deliver high-grade, compliant tantalum concentrate from Africa to Asia — with full documentation, SGS assays, and CIF shipment reliability. Aligned with long-cycle demand in electronics, aerospace, and medical sectors.

View Product Specifications

Global Demand for Tantalum: Applications and Growth Forecasts

Tantalum’s unique physical and chemical properties — corrosion resistance, high melting point, and capacitive efficiency…

Risks and Volatility in the Tantalum Market: Supply, Pricing, and Trade Disruptions

Tantalum supply chains remain structurally fragile, with concentrated origin zones, limited transparency, and exposure to…

How To Compare Tantalum Concentrate Offers: Price, Specs, Compliance, and Supplier Risk

Tantalum concentrate offers vary widely in price, specification, delivery terms, and documentation quality. For buyers…

Tantalum Concentrate Price Trends: Key Drivers and Market Dynamics

Tantalum concentrate prices reflect tight supply conditions, complex logistics from African origin countries, and growing…